Are you travelling to China soon? One question often comes up before you leave: how do you pay in China? In China, banknotes and coins are almost gone and most payments are made via mobile apps. Luckily, foreign travellers can use these payment methods too. Here is a simple, up-to-date guide to help you pay for your purchases like the locals.

💡 How to pay in China as a foreigner

Payment method | Usable by foreigners | Usage scenarios | Highlights | Things to know |

Alipay | ✅ Yes | Almost everywhere: Shopping centres, supermarkets, restaurants, hotels, taxis, metros, tickets for tourist attractions, etc. | Fast, secure, French interface. Link with an international card. | Visa/Mastercard required |

WeChat Pay | ✅ Yes | WeChat installation required | ||

Bank card (Visa / Mastercard / UnionPay) | ✅ Yes | Hotels, airports, major chains, ATMs | Simple and familiar | Not accepted everywhere |

Cash (RMB / CNY) | ✅ Yes, but not very practical | Small shops, markets, taxis, buses, villages, emergencies | Universal, accepted by all | Not widely used in the city, exchange rate issue |

📱 Mobile apps for payment in China: Alipay & WeChat Pay

In China, your phone is your wallet. The two mobile payment giants: Alipay and WeChat Pay, are accepted almost everywhere. Whether it's for buying a coffee, paying for a taxi or booking a tour, a simple QR code scan is all it takes.

💰 How to pay using Alipay in China

Alipay is one of the most popular applications in China, used by millions of people to make fast and secure payments. But Alipay is not limited to payments alone: it is also an all-in-one platform that allows you to book tickets, manage your finances, and much more. Thanks to its many features, Alipay simplifies daily life, whether for online purchases, services, or even managing your budget.

💼 How to use it?

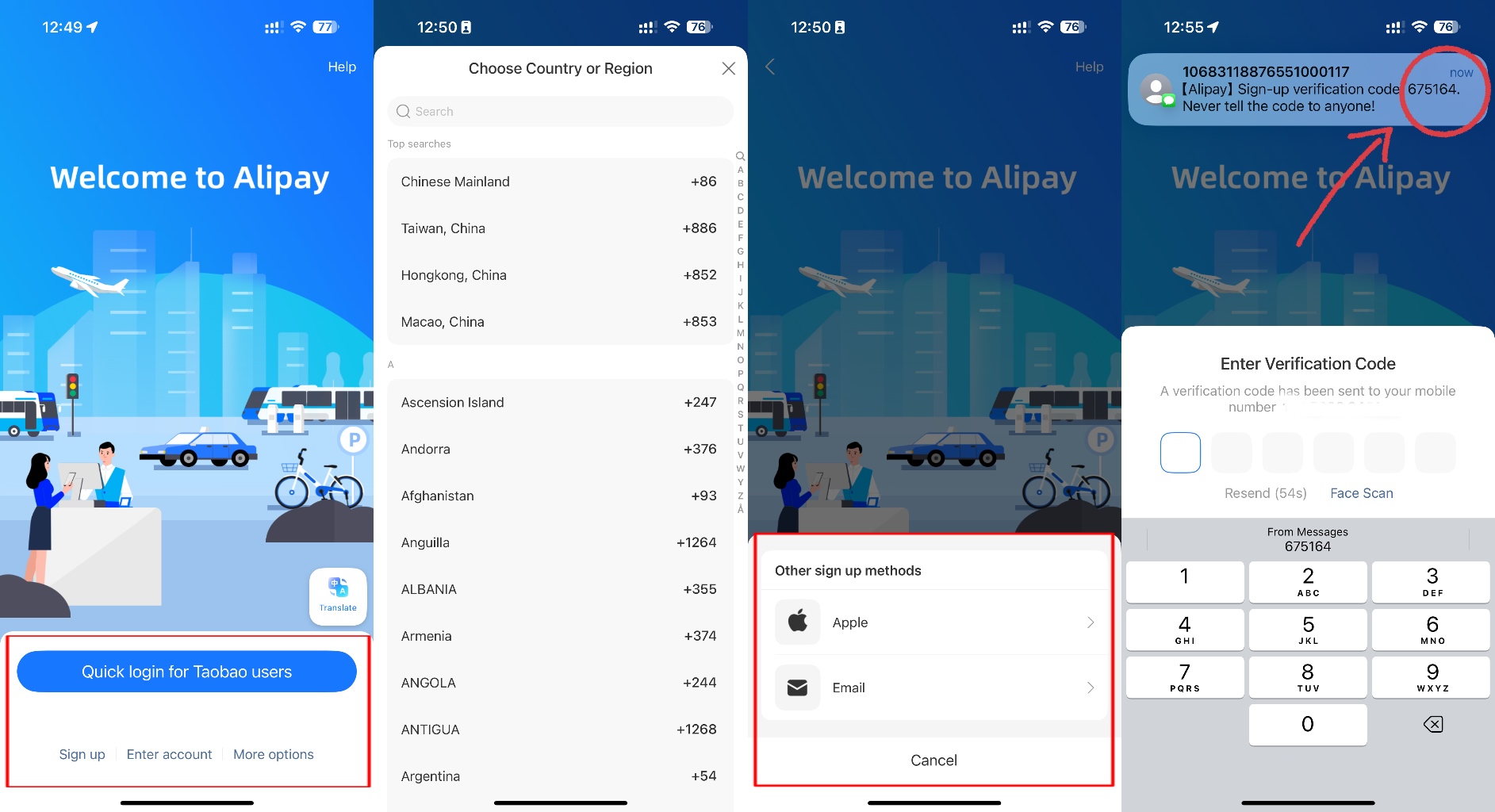

- Download Alipay from your App Store or Google Play.

- Choose the international version (interface in English or French).

- Register with your international mobile number: Click 'Register', select your country/region, then enter your mobile number. You will receive an SMS containing a verification code.

- Create a password: This password will allow you to log in and authorise certain payments.

- Real-name authentication: the crucial step, you will need to:

Take a photo of the personal information page of your passport.

Follow the instructions for facial recognition.

The system will automatically recognise and populate your name, passport number, and other information. Please check carefully. - Add your Visa, Mastercard, Discover or UnionPay card: You must enter your card number and provide the other requested information.

- You can start scanning QR codes to make payments or use the other services offered.

🔥 Additional benefits of Alipay

- TourPass: If payment with a saved card fails, credit your e-wallet with a set amount and pay from this balance to increase success.

- Favourable exchange rates: Alipay often gives better exchange rates and clearly shows the converted amount in pounds or euros.

✅ How to pay using WeChat in China

WeChat Pay is much more than just a payment method. It's a social and financial platform that integrates into everyday life in China. In addition to making payments, you can chat, buy products, book services, and much more. It's the most widely used application in China, particularly for small-value payments.

💼 How to use it?

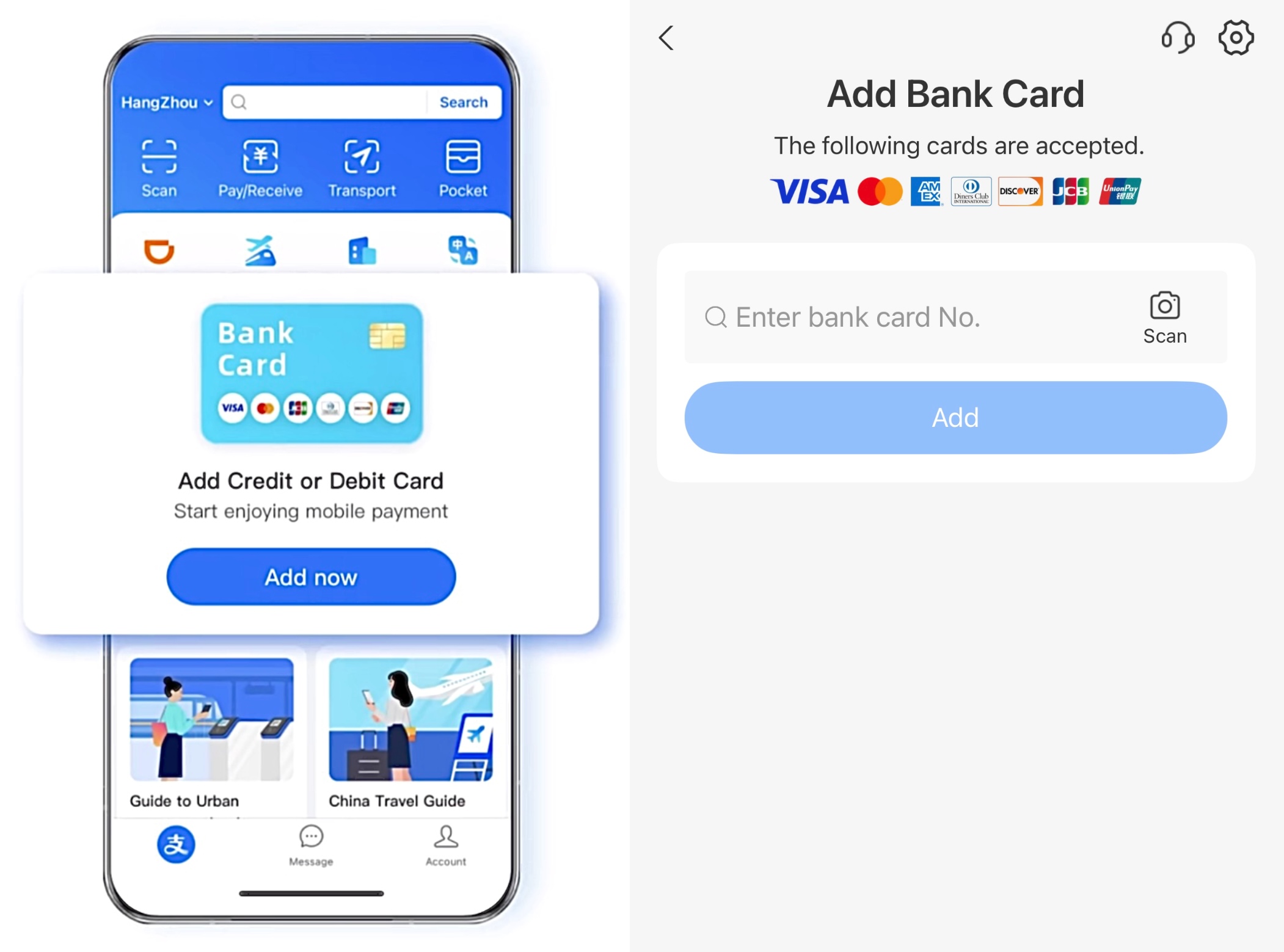

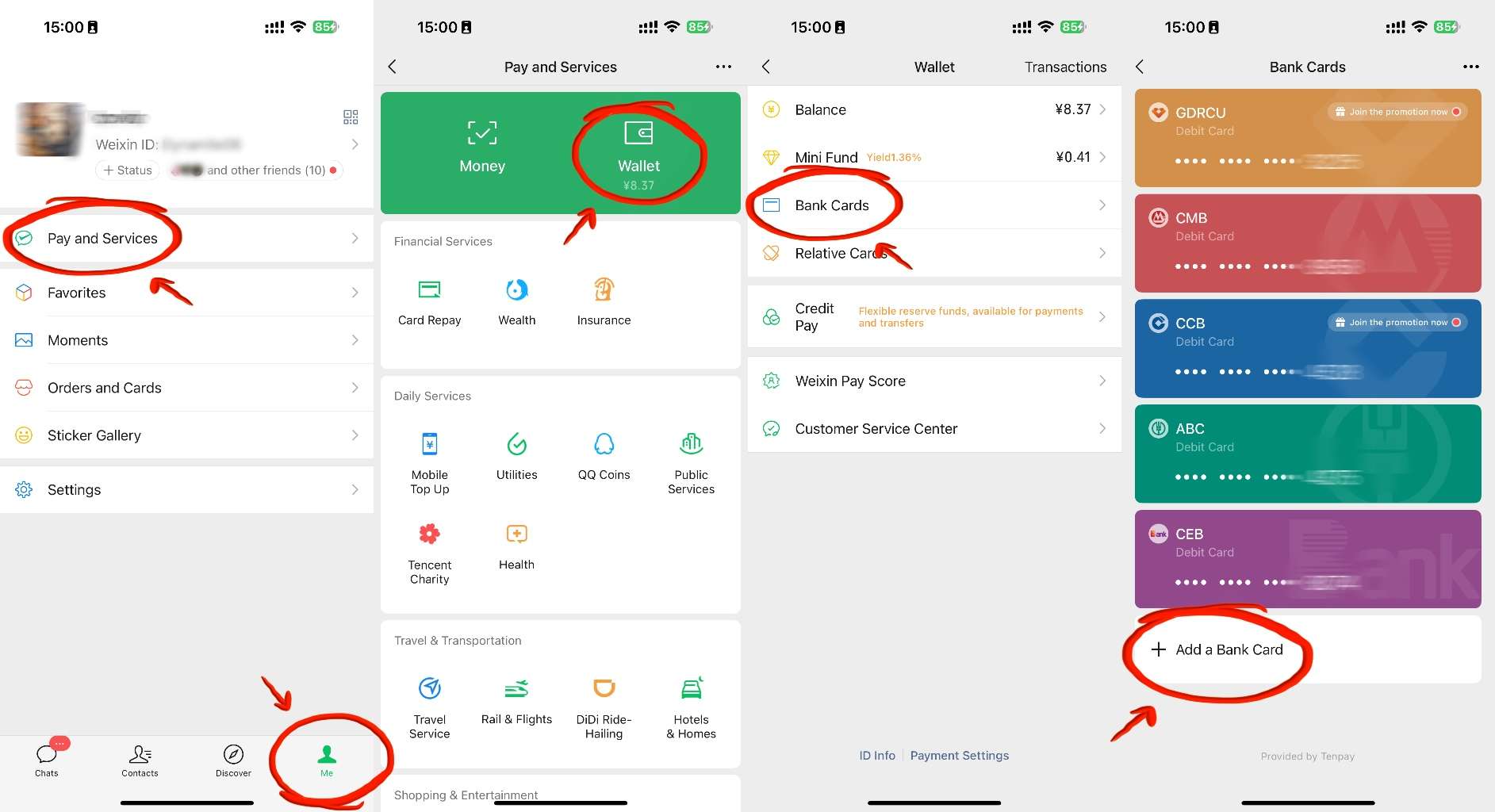

- Download the WeChat app, and create your account with your phone number

- Go to “Me > Payment and services > Wallets” or search for “WeChat Pay” directly

- Add your bank card: enter the information as indicated on your passport

- Verify your identity (same steps as with Alipay) and set up your payment code or biometric ID.

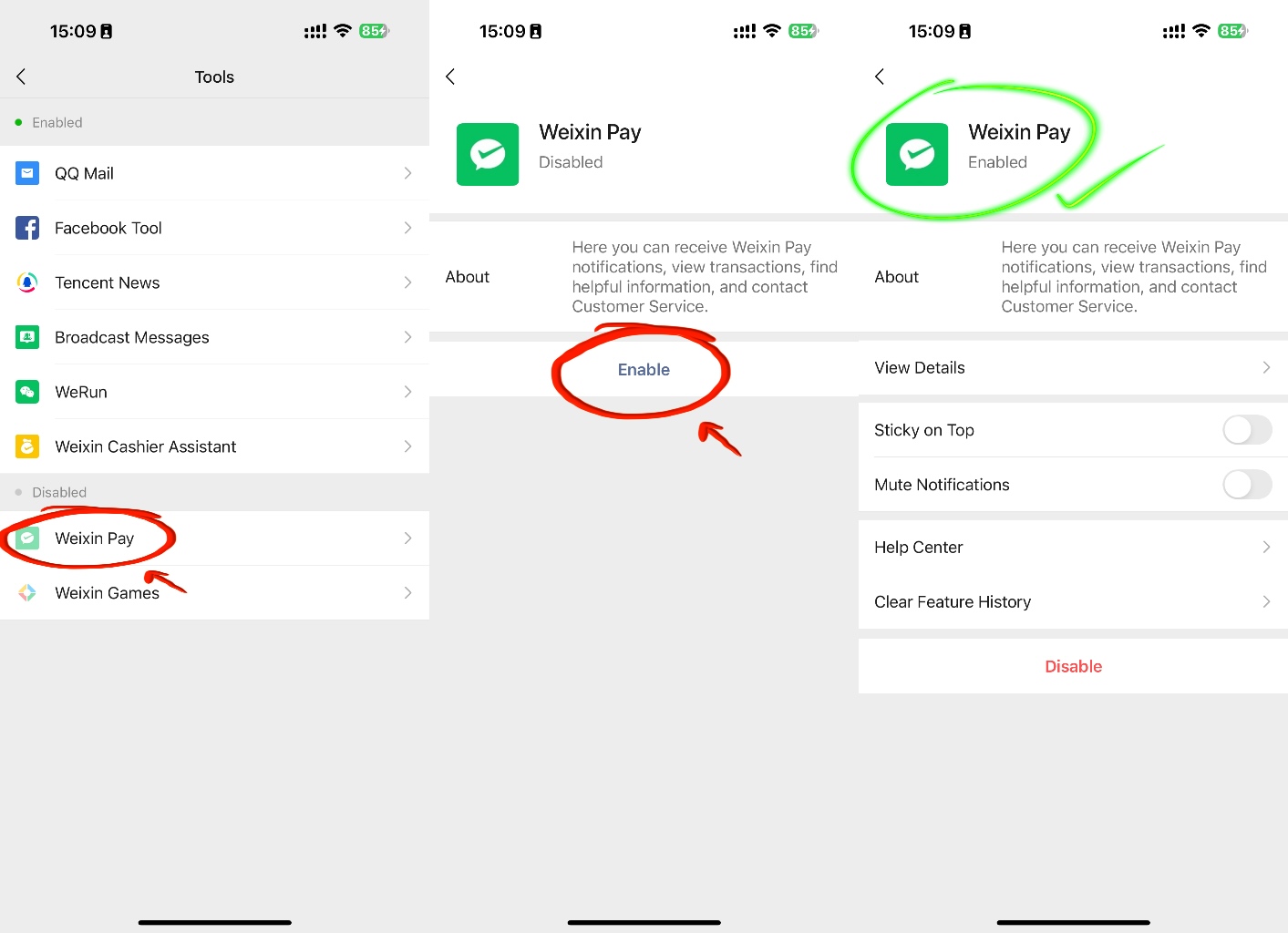

- Tap Me at the bottom →Settings → General → Tools → Weixin Pay → Tap Enable

📌 Important notes regarding WeChat Pay:

- Feature integration: WeChat Pay is deeply integrated into the messaging app. For French tourists, its use may prove less intuitive than with Alipay.

- Payment limits: Accounts that have not completed real-name authentication are subject to very low payment limits, making it almost impossible to cover travel-related needs. Real-name authentication is therefore mandatory.

💡 Pros and Cons of Mobile Payment

✔️ Benefits | |

Widespread adoption, practical and effective | The vast majority of merchants in China (including street vendors) accept Alipay and WeChat Pay. Payment is simply made by scanning a QR code, which significantly improves transaction efficiency. |

Multi-use Integration | In addition to payments, Alipay and WeChat Pay also allow you to order ride-hailing services (like Didi), meals, tickets, etc., thereby catering to various travel needs, and some are available in French. |

Favourable exchange rate | Alipay and WeChat Pay offer more favourable exchange rates for foreign users and often include exclusive discounts or exclusive coupons, allowing savings on travel expenses. |

❌ Disadvantages | |

Foreign card restrictions | French tourists should use a credit card that allows international payments (Visa/Mastercard, for example). Some small merchants only accept bank cards issued in China, which may lead to payment failures. |

Network configuration required | A stable mobile network is essential. The service will be unusable if the phone's battery is flat or if the network signal is weak, which can prove problematic for older tourists unfamiliar with the system. |

Real-name authentication | Uploading a copy of your passport is required to complete real-name authentication. The registration process is relatively complex. |

👉Search Cheap China Attractions Tickets and Tours on Trip.com

Hotels: Save up to 10% (Book online or on H5)

Homes & Apts: Save up to £39 (App-only deal)

💳 How to pay by bank card in China

International bank cards work, but their usage is limited. Here's what you need to know according to the networks:

💠 UnionPay (银联)

UnionPay is the Chinese banking network, historically the most widely accepted in the country. For travellers, a UnionPay card issued by a European bank or a partner neobank can offer smoother acceptance at local terminals. ATMs bearing the UnionPay logo are very widespread, which facilitates cash withdrawals in RMB. Even if mobile payment dominates, UnionPay remains a reliable option when QR codes are not possible.

** Image source: official UnionPay website

🏧 Use cases

- Cash withdrawal at ATMs displaying the UnionPay logo

- Payment in department stores, supermarkets and some national chains

- Business hotels and transport networks (ticket counters, ticket machines)

- Plan for alternative solutions if Alipay/WeChat Pay is unavailable.

💳 Visa and Mastercard

Visa and Mastercard are widely recognised internationally, but their acceptance in China remains concentrated in 'international' environments. You can generally use them in chain hotels, airports, high-end shopping centres, and some international establishments. In small shops, neighbourhood markets, and some local restaurants, acceptance remains inconsistent, with QR codes remaining the norm. Remember to activate international usage, check your limits, and fees (2-3% possible) with your bank.

** Image source: official Visa website

✨ Use cases

- International hotels, airports, premium shopping centres, restaurants catering to foreign customers

- Some international brands and major attractions (depending on terminal)

- Security deposits and guarantees at hotel check-out, deposit payments

- Online purchases on platforms accepting Visa/Mastercard (depending on merchants)

- Backup solution when the terminal displays international logos

💡 Pros and cons of card payment

✔️ Benefits | |

Strong international acceptance | Large shopping centres, hotels, and restaurant chains generally accept Visa/Mastercard cards. UnionPay cards also offer discounts at some retailers, making them ideal for large purchases. |

Enhanced security and protection | Mechanisms for reporting losses and large-scale fraud prevention; some banks offer travel insurance for individuals, providing greater peace of mind than paying in cash. |

No prior top-up required | Linked directly to your bank account, your card does not require any prior top-up or complex procedures such as mobile payment. |

❌ Disadvantages | |

Limited payment situations | Street shops, night markets, and public transport may not accept card payments; other payment methods may be required. |

Cross-border transaction fees | Some French banks charge currency conversion fees or transaction fees for overseas transactions, which increases hidden costs. |

Credit card fraud risk | The use of your card with unauthorised merchants carries a risk of data breach. Please be extra vigilant to protect your card. |

💷 Payment methods in China: paying in cash

Even though China is highly digital, cash remains a good safety net. In major cities, many businesses no longer expect to receive notes; however, in rural areas, small markets, or when the internet is unavailable, cash simplifies things. Think of it as your plan B: not your primary method, but the one that can save a tricky situation.

Rural areas / small towns where QR codes are not routinely used

Street stalls, small markets, local car parks, pay toilets, lockers, etc.

Network outages, low battery, or app refusing foreign cards

Small payments where the merchant prefers cash to a 'foreign' QR code

Major banks (Bank of China, ICBC, CCB, ABC…): the safest for exchanging EUR → RMB.

Airport currency exchange counters: very convenient upon arrival.

ATM: If your Visa/Mastercard/UnionPay card is activated for overseas use, withdraw RMB directly from recognised bank ATMs. Check bank fees and limits.

💡 Pros and Cons of Cash Payments

✔️ Benefits | |

Versatility | Usable everywhere, particularly suitable for traditional markets, small businesses, and remote areas, without the need for electronic devices. |

Clear payments | Direct payment allows for better control over spending and avoids problems related to exchange rate fluctuations or additional fees. |

Privacy Policy | No personal information is required, which is suitable for privacy-conscious travellers. |

❌ Disadvantages | |

Easy to lose | Carrying large sums of cash exposes you to theft, and it is impossible to report a lost item. |

High exchange fees | Exchanging yuan in France in advance can result in unfavourable exchange rates or high transaction fees at Chinese airports. Exchanging at a bank is the best solution. |

Not accepted everywhere | Some places (such as self-service bicycles and cash machines) no longer accept cash payments. |

👉Search Cheap China Attractions Tickets and Tours on Trip.com

Attractions & Tour Tickets

-

Badaling Great Wall

-

Chimelong Safari Park

-

Universal Beijing Resort

-

Chengdu Research Base of Giant Panda Breeding

-

Shanghai Disney Resort

-

Ocean Park Hong Kong

⚙️ Essential tips for paying in China easily

🌐 Get your internet ready

You need an internet connection for mobile payments. In China, some foreign platforms like Google, Facebook, and Instagram do not work without a VPN. Install a trusted VPN before your trip if you want to use them. Alipay and WeChat Pay work fine without one.

📲 Download your apps before arrival

Install Alipay, WeChat, and any other payment apps while still in your home country. Add your cards and try a test payment if possible. Once in China, some apps may be hard to download without access to a local app store.

🔒 Keep your data safe

Turn on two-factor authentication for your bank accounts and limit how much money is available in your apps. If your phone is lost, you can block your account from another device.

💡 Be careful with QR codes

Only scan codes shown by real shops or staff. Never use a code sent in a message, as scams can happen, even if rarely.

💳 Have a backup plan

Carry a little cash, a Visa or Mastercard, and your payment apps to stay worry-free.

❓ FAQ about payment methods in China

Q1: Can you use Apple Pay or Google Pay in China?

→ Not really. These systems only work in a few international stores (Starbucks, Apple Store, etc.).

Q2: Do I need to open a Chinese bank account?

→ No, that's no longer necessary. Alipay and WeChat Pay accept foreign cards.

Q3: Can I withdraw money with a foreign card?

→ Yes, at ATMs displaying Visa, Mastercard or UnionPay. Simply check your bank's fees.

Q4: Are tips mandatory?

No, tipping culture is very rare. You can leave a small one if the service was exceptional.

Q5: Can we pay without internet?

→ No, mobile payments require a connection. In places where network coverage is weak or non-existent (no Wi-Fi), the use of cash is necessary.

NO.1

NO.1